Financial startup VIVE can’t do without the Cloud

CloudNation helped developers from Fintech startup VIVE with building a scalable and secure public cloud environment in a very short time. Crucial for their growth as well as an important part in their continued compliance for their DNB banking license.

Continue reading

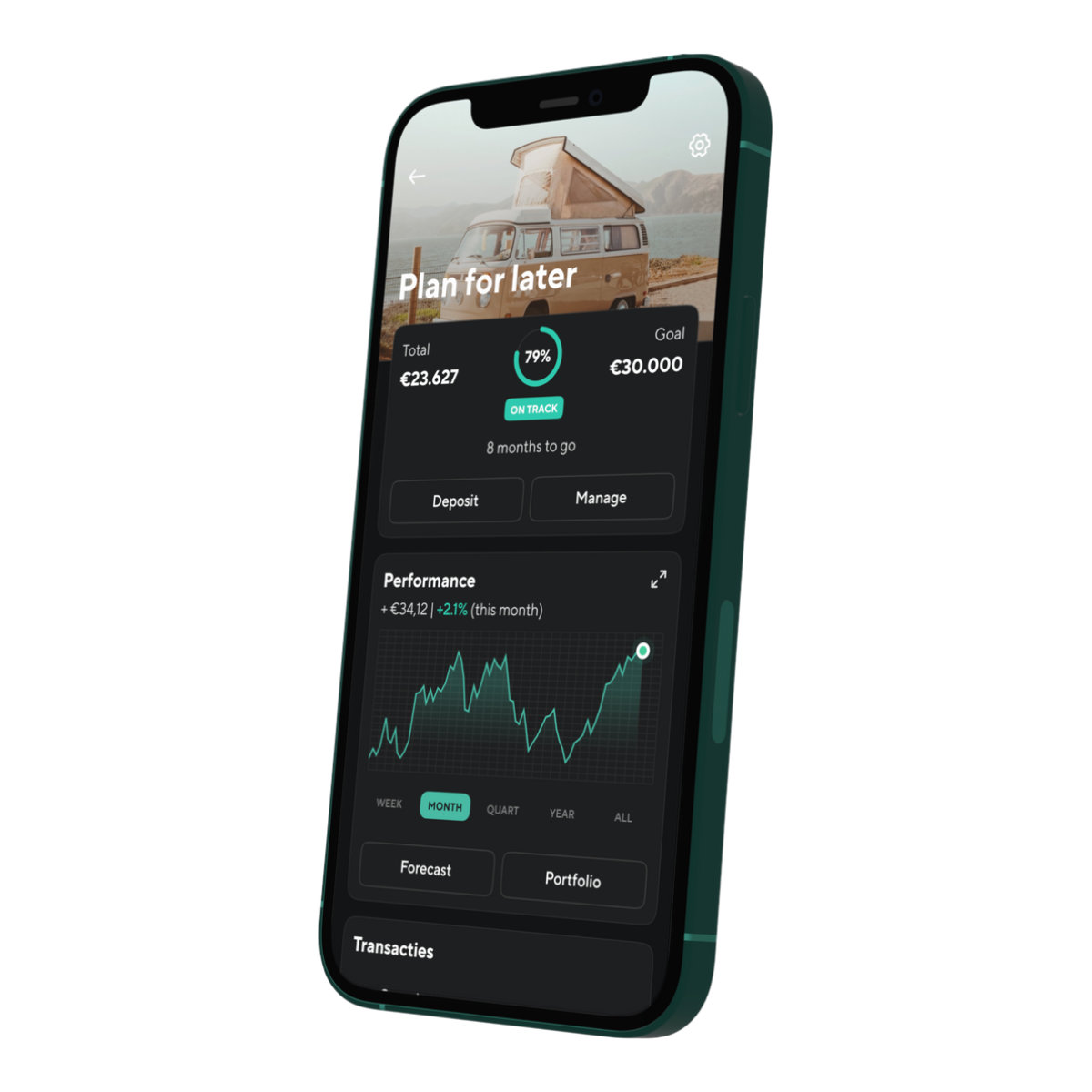

The Dutch startup VIVE will soon launch an app which that allows users to automatically, helped by algorithms, achieve their financial goals. The biggest challenge: how to efficiently develop a scalable and secure environment for the app in the shortest time possible? “We have done it all in one and a half month.”

Alexander Brouwers is VIVE’s CEO and has been working for quite some time on building an app that allows everyone to realize their financial goals. Brouwer: “Investing is already accessible to everyone, but it is a lot less simple to manage your capital and accomplish your financial goals”. That is the next step. For “money right now” there are banks, for “money in the future” there is VIVE.

(This article previously appeared in Financiëel Dagblad.)

Conquering the world

An innovative startup in Financial Services is not built in a day. Before you can conquer the world there are several phases to transition through. Brouwer explains: “You first estimate if there is a need for the service”. Quantative research was difficult, because we did not have a financial services license yet. So we could not have the concept tested by large amounts of people. What we could do was talk about it with hundreds of people, with 50 of them we did in-depth interviews according to an objective research method.

After validating the concept you check to see if the technology works as expected. At a later stage questions come up like: “how do we ensure that we offer our customers a safe environment and how can we make it scalable?” How do you accomplish this in a quick manner at limited costs. How do you tackle this challenge?

Safe and scalable

VIVE was working on the App and technology and had deployed it in the Amazon Web Services (AWS) cloud platform. “For us it was important to ensure the product was working properly. Then we started looking at making it secure and scalable”, Brouwer continues, “then we started looking for expertise on cloud technology. When we knew the AFM license was underway we issued a tender. One of the potential parties was CloudNation. The overriding factor with CloudNation was the personal rapport, their vision on development and their knowledge, their approach to the project was also appealing. They make companies owner of their cloud platform by training them instead of doing their work for them. This matches with our needs, because we’d like to keep development and operational management of our technology in our own hands.

Technology for everyone

Fintech startups are popping up at a high rate over the last years. VIVE seems to operate in a very competitive market. “Yes and no”, says Brouwer. “There are a lot of companies that advise people about their capital. But there are few or practically none that do this on a fully automated manner, especially for people that have a more modest capital for investment. This target audience comes into view because we can offer tailored advice on a large scale through the use of our digital platform and algorithm. The app gives users much more control because of the accessible way of communication. It’s a bit like checking the news or your savings account balance. You directly know the current state of affairs and can easily make changes to it.

Where VIVE has the ambition to make capital management accessible to anyone, CloudNation has this ambition with technology. “The cloud doesn’t discriminate.” Says Arjen Vriens, co-founder and Chief Commercial Officer of CloudNation. “Previously the value-chain of IT was locked. You could only acquire IT-resources through certain distribution channels and you were bound to a certain IT-partner. The cloud offers access to technology for everyone. This vision was the start of CloudNation.

"The cloud does not discriminate and provides access to technology for everyone."

Arjen VriensCo-founder, CloudNation

The move to the cloud

VIVE is a startup and thus used to moving quickly. Brouwer: “as a young company scaling up quickly is almost natural behaviour. We skipped the world of old technology and expensive datacenters.”

The advantages of a cloud platform are well known to him: “Our main advantages are speed of implementation, scalability and cost management.” The choice for the AWS platform was based on solid research. “We took a good look at pricing, expertise, as well as the experiences of other parties in the financial sector.” VIVE is a regulated financial institution and thus it has high demands. It is good to see that some parties, like Ohpen, developer of a cloud based banking platform already went through this experience. Ohpen has made the step into the cloud a few years ago in consultation with the DNB. The experience of pioneers like Ohpen has been helpful to our own journey into the cloud.

Security

Vriens underlines the aspect of security in the cloud: “Especially for a financial institution security is very important. If you want to build a secure environment on your own, you would be looking at a huge investment. With public cloud this is significantly less. In my opinion the term public cloud is very unfortunate. It is not accessible for everyone but actually rather well suited to being a secure platform. In the area of compliance several large gains have been made. The requirements of the DNB are known. You can enter these requirements and automate them by using cloud technology. Reporting on compliance requirements becomes a lot easier; continuous compliance is reachable. It is a lot of work to build this in a self-managed environment.

Acceleration

VIVE received their coveted license from AFM in June. All lights went green and the process accelerated. The big goal is to launch the app this autumn. The last preparations are being made. According to Brouwer VIVE is busy receiving feedback from a select group of customers: “In the past we looked at customers, their needs and the role of an App in that process. Because we did not have a license we couldn’t offer Financial Services yet. So there were no test runs with the app. Since we received our license we are finally able to do so. Currently we are receiving very valuable feedback from our customers, allowing us to improve the app even before the general launch in Q4. Our goal is to have three to five thousand customers before the years end.

Collaboration in practice

VIVEs full attention is focused on the launch in Q4. Based in the AWS cloud platform.

How did this setup of the cloud come to be? Vriens “Often times we at CloudNation start with a technology validation, a so called well-architected review: is the technology deployed according to best practices, is the designed environment fit to reach the customers goals? Using AWS for such a workload is smart. Amazon is the largest cloud provider and has a lot of experience worldwide. We as partner try to soak up this experience and knowledge and so we can translate it to specific customer situations. Like we did here with VIVE.

Fast and compliant

After the validation phase we progressed to the building phase. Vriens: “the cloud is like a collection of Lego pieces that you want to connect in the best way. We bring our knowledge and experience and enable our customers to accelerate their process. This is what it is all about: you quickly want to build something that can measure up to the resources of a multination. Besides being quick a company like VIVE also wants to offer the highest quality and as a financial institution also be compliant.

In the age of the cloud innovation has become more accessible. “Why invest in something new, whilst not knowing the result?”, a rhetorical question asked by Vriens. “in the past innovation was available to companies that had expensive datacenters and money to spend. AWS changed this: it makes technology available to anyone at the same price. The cloud offers the possibility for endless growth with large up-front investments.

Faster

“By this point the CloudNation experts have become like a part of our team”, says Brouwer. “No horror stories like you read everyone once in a while. And that was no surprise to us: during the selection process we already noticed that we connected well and spoke the same language. VIVE has an experienced development team which was able to determine that collaboration with CloudNation works well. In the end our collaboration led to the building of four environments in the AWS platform, running our App and platform. The help of CloudNation has definitely increased our product development. We went through the whole process in one and a halve month.

Vriens: “It is important to differentiate between skills – everyone can achieve certification – and real competence. Can someone who just got their driving license safely navigate the Champs-Élysées? We have built our competence over the years by doing project with big organisations. That’s how we earned our stripes. If you want to achieve this level of competence on your own you will get their but it will be a bumpy ride. As a startup or part of a larger organization you don’t have the luxury of time to built this up.”